For the first time since Ag Equipment Intelligence and Cleveland Research launched the Dealer Sentiments & Business Conditions Outlook survey in April 2011, sales of GPS and precision farming equipment took a backseat to another product category.

According to dealers responding to the June survey, commercial & consumer products just barely edged out GPS and precision farming products in sales in May. Besides the strong showing of C&CE since the beginning of the year, dealers are telling us that tracking sales of precision farming products is becoming more challenging as so much of the new machinery being sold is coming equipped with the precision gear.

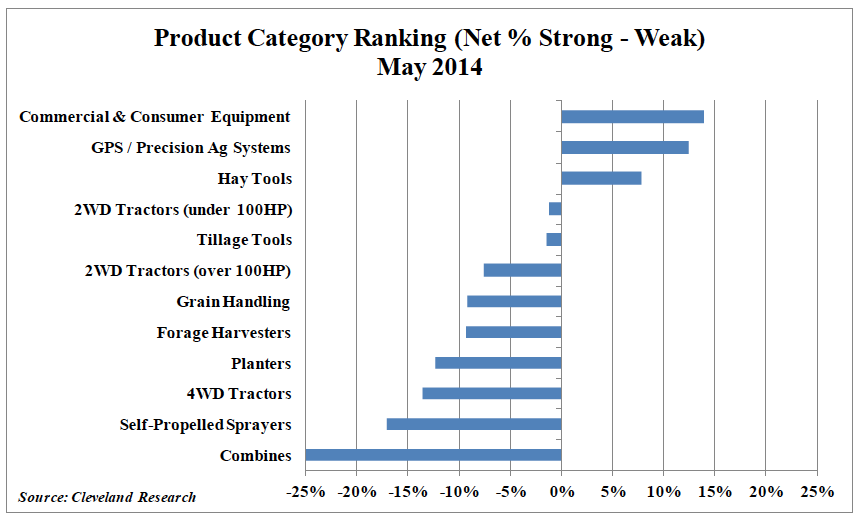

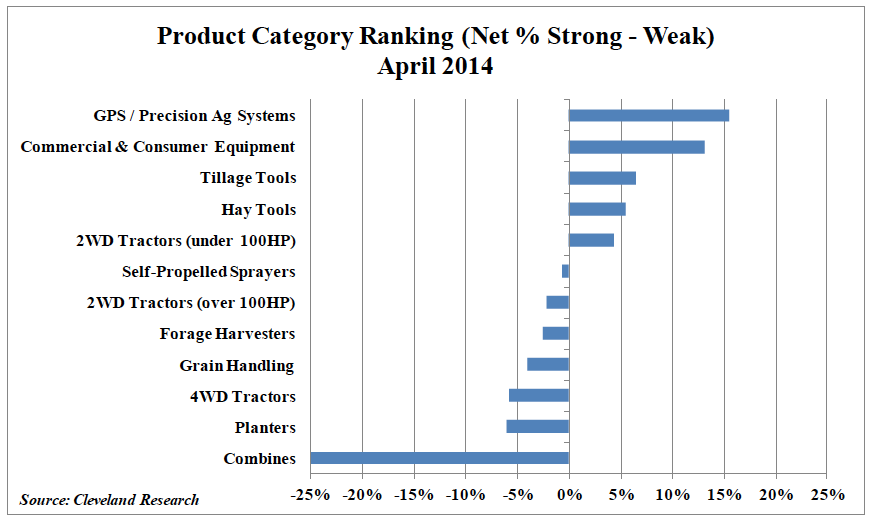

Overall, 3 of the 12 product categories ranked in net positive territory in May vs. 5 product categories in the previous month. C&C equipment was the strongest category (net 14% reporting strength), displacing GPS/precision farming systems for the first time in 17 months, while combines were the weakest category for the 13th straight month (net 34% reporting weakness).

Comparing April to May, sales of only 2 of the 12 product categories were reported as “better,” while the remaining 10 were reported as “worse.” Self-propelled sprayers saw the largest softening as a net 17% reported weaker sales vs. a net 1% reporting weaker sales during the previous month.

Post a comment

Report Abusive Comment