In today’s newscast, AGCO reveals its Ideal combine to North America — the first “clean-sheet” design of an axial combine in the industry in decades. In this week’s Technology Corner segment, we take a look at the challenges dealers face in recruiting and retaining precision service technicians. We also take a look at how large ag equipment sales rebounded in May and how Deere’s retail sales compared to the industry average, the changes in machinery values on Illinois farms over the last 10 years and a deterioration of European dealer sentiment in June.

On the Record is brought to you by Spader Business Management.

Spader Business Management’s team of industry experts provide business insights, ideas and concrete tactics through training and consulting. Generations of business owners and operators have also relied on our 20 Groups to capitalize on new opportunities and industry trends by learning directly from their peers. Learn more at spader.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

I’m managing editor Kim Schmidt. Welcome to On the Record! Here’s an update on what’s currently impacting the ag equipment industry.

AGCO Unveils Fendt Ideal Combine

Earlier this week, AGCO unveiled its latest innovation — the Fendt Ideal combine — to North America during the Canada Farm Progress Show in Regina, Sask.

The Ideal represents what AGCO describes as the first “clean-sheet” design of an axial combine in the industry in 30 years.

The graphite gray colored combine will be available in Class 7, 8 and 9. AGCO Senior Vice President Bob Crain says they’ve assigned a select number of dealers for the initial rollout who will help with demonstrations this fall. Additional Fendt Ideal dealers will be assigned during the third and fourth quarter to be ready for the 2019 selling season.

“We're going to distribute this through a Fendt Ideal dealer network. Only a Fendt Ideal dealer network, and we're going to be looking at it on an individual basis, the market or the industry size and what that opportunity represents. We're going to be looking at the combine experience, that the individual dealer’s possess. And just as important, the passion that this dealership has for the combine business and, last but certainly not least, arguably more important than anything else will be the customer support capabilities of the distribution network.”

While the combine will be marketed as a Fendt product in North America, for world markets it will be supplied through Challenger, Fendt and Massey Ferguson dealerships starting in the “neutral” uniform graphite color with the individual brands represented only by their decals.

Dealers on the Move

This week’s Dealers on the Move include AgriVision, JD Equipment and Pape Machinery.

AgriVision, a John Deere dealer in Iowa, has reached an agreement with Van Wall Equipment to purchase Van Wall’s Onawa, Iowa, location. This brings AgriVision’s total locations up to 16.

This isn’t the first time store ownership has changed hands between the two dealerships. In 2015, Van Wall bought its Knoxville, Indianola and Albia, Iowa stores from AgriVision.

John Deere dealer JD Equipment has acquired Cahall Brothers’ Georgetown, Ohio, and Flemingsburg, Ky., locations. The dealership now has 10 locations in Ohio and Kentucky. In our last episode, we reported that Cahall had sold one of its locations to Koenig Equipment.

Pape Machinery opened a new location in Ponderay, Idaho, on June 13. The new store carries both the John Deere Agriculture & Turf and Construction & Forestry lines.

Now here’s James DeGraff with the latest from the Technology Corner.

Service Tech Recruitment an Ongoing Precision Predicament

Last month, I stopped by Nebraska Equipment, a Case IH dealer based in Seward, Neb., to discuss hiring in the precision industry with sales manager Kenny Pekarek. The timing of the visit was fitting, as the dealership was just one week into hiring its first precision intern, not coincidentally during the heart of planting season.

The intern, who helps the store’s three full-time techs with lower-scale maintenance, has additional plans to provide crop imagery services for customers using his personal drone. He was successfully recruited through a family-to-family connection with Nebraska Equipment’s store manager, although Pekarek says opportunities to find and develop young precision service techs are typically few and far in between.

“This is our first year. We've been here for 33 years now, and this is the first time I know of that we've had an intern for precision, and it's very difficult to find good, young, qualified kids, especially when this is a seasonal ... anything auto-steer/ GPS is seasonal, OK? You need them definitely in the springtime. Planting time — that's go time — and then fall, a little bit for harvest. But in between there, you want to find somebody that's able to do other things in your store, whether it's set up equipment, work on equipment, stuff like that, and they don't all want to do that. They want to just do precision. Well, it's hard to keep a guy busy, and, first of all, it's hard to find good, young techs. The techs we got now have been here, they're mechanics, and then they kind of learn on the go. They went to school, they go to precision schools in the offseason and they just learn on their own, so, once you get them, you definitely want to keep them. But finding new ones, it's getting difficult because there's a lot of competition. I mean, you've got seed companies out there, you've got your other manufacturers, they're all going through the same thing. They're looking for good, young techs.”

Results from the Precision Farming Dealer 2018 Benchmark Study indicate that Nebraska Equipment isn’t alone when it comes to concerns with recruiting and retaining precision service techs. Over 63% of respondents in the study noted “Precision Staff Expansion” as their top priority for the next 5 years. In addition, 41% of respondents reported paying new specialists at least $41,000 per year in 2018, almost doubling the 2017 total.

With the complexity of precision services rising as quickly as the demand to provide them, perhaps we’ll see full-scale recruiting programs as the next industry-wide trend for dealerships.

Ag Equipment Sales Rebound in May

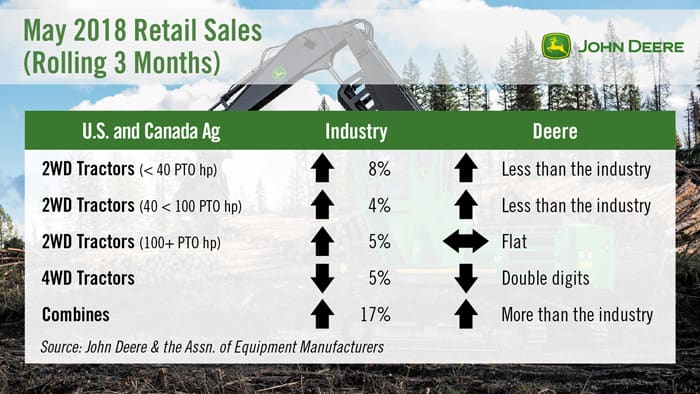

North American large ag equipment sales in May were positive across the board, according to the Assn. of Equipment Manufacturers latest report. “Large ag retail sales rose 17% year-over-year in May, breaking out of the choppy low-single-digit growth/decline experienced since October,” said Baird analyst Mig Dobre in a note. U.S. tractor and combine sales were up 21% year-over-year and Canadian sales increased 6%.

In terms of demand seasonality, Dobre says May is an average month and notes that the acceleration is consistent with Deere & Co.’s prior commentary calling for growth pick-up on already booked orders. However, some headwinds still remain, he says, including grain prices that are off their late-May highs and trade uncertainty.

4WD tractor sales increased 8.3% year-over-year in May following the 12.5% decrease in April. U.S. dealer inventories of 4WD tractors were down 13% year-over-year in April. John Deere’s 4WD tractor retail sales were lower than the industry average and were down double digits.

Row-crop tractor sales were up 18% year-over-year after a 3% decline in April. U.S. row-crop tractor inventories were down slightly (less than –1%) year-over-year in April. Deere’s retail sales for row-crop tractors in May were flat.

Combine sales increased 21.5% in May following a 40.7% increase in April. U.S. combine inventories improved 1% year-over-year in April. John Deere retail sales for combines were strong and were up more than the industry average in May.

Machinery Values More than Double Over 10 Years

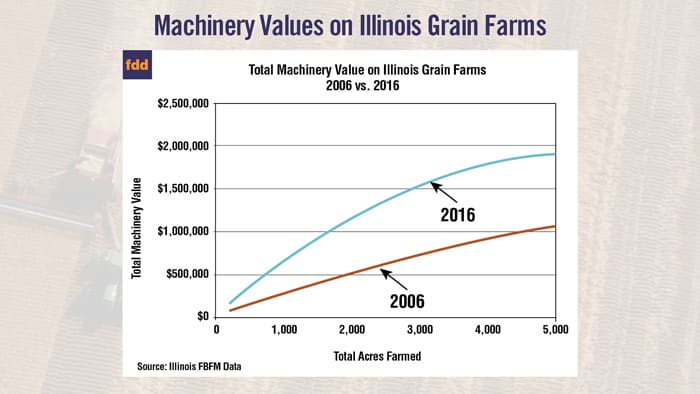

A new report from the Illinois Farm Business Farm Management Assn. and the Department of Agriculture and Consumer Economics at the University of Illinois shows that average machinery values on a 1,000 acre farms in Illinois more than doubled from 2006 to 2016.

In 2006, a farmer who had 1,000 acres on average would have about $300,000 worth of machinery. By 2016, that same size farmer was averaging about $650,000 worth of machinery. That represents an increase of about 124% in 10 years.

Farmers with 2,000 acres saw an even greater increase in machinery values over the same period. Machinery values increased about 140% from 2006 to 2016 for these farmers.

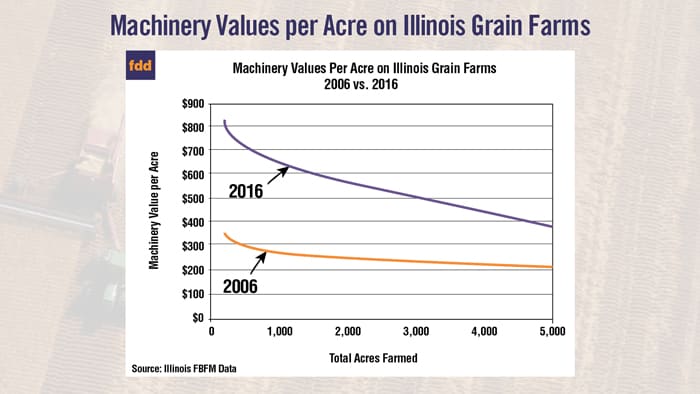

According to the report, the smaller acreage farms had the largest increase in machinery value per acre going from about $280 per acre for a 1,000 acre farm in 2006 to $660 per acre for a 1,000 acre farm in 2016, or a 136% increase. 2006 machinery value on a per acre basis slowly decreased as the total acres on the farm increased.

The authors of the report say, “The increase in machinery values was not only due to the increase in actual value of machinery, but in addition, larger equipment and more technology. More machinery was also being purchased due to the increase in the federal expense election, allowing more of the capital purchase to be deducted as a current expense, if all of the qualifications of this tax law were met.”

European Dealer Sentiment Deteriorates

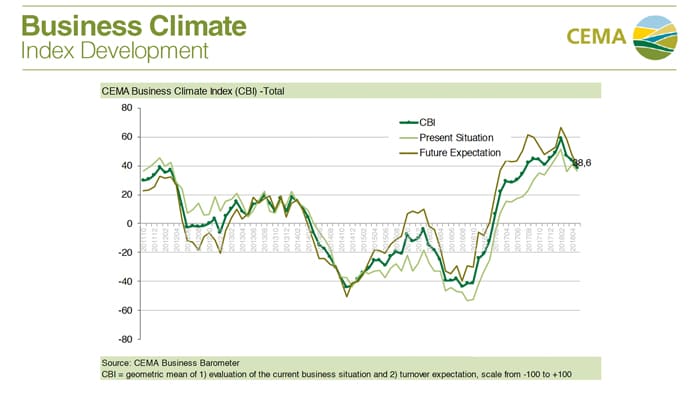

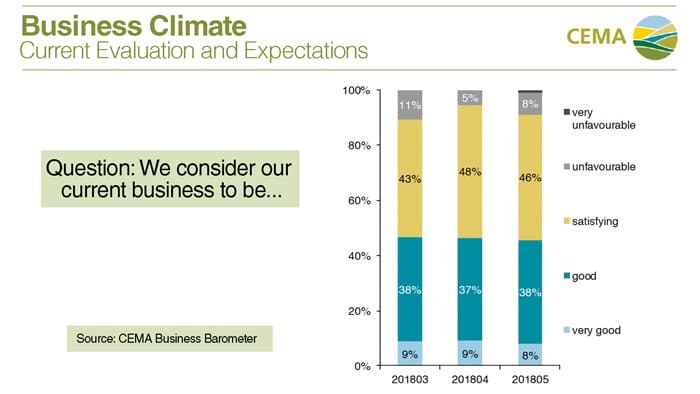

European ag industry trade associations VDMA and CEMA report that the business climate for the agriculture equipment industry deteriorated further in its June survey of dealers. According to the survey results, dealers’ future expectations have become more cautious.

According to the survey, 45% of dealers expect higher turnover in the next 6 months compared to 50% in May and 52% in April. But, 43% of dealers expect turnover to be unchanged.

Overall, respondents were positive about their current business with just 10% viewing their business as either unfavorable or very unfavorable. On the other hand, 46% of respondents rated their business as either good or very good and another 46% rating it as satisfying.

According to the survey, participants expect revenues to be up 5% in 2018 and up 4% in 2019 across the EU.

And now from the Implement & Tractor Archive…

Implement & Tractor Archives

Twenty-five years ago on June 19, 1993, The Rock Island Dispatch-Argus reported that “As J I Case Co. reduces its dealer inventories to better match expected demand, the Racine-based farm equipment manufacturer has found itself in the unusual position of having pre-sold its entire combine production for the year. "Everything we're making has an order," said Joseph DeSarla, general plant manager in East Moline, where Case makes its combines.

CNH closed the East Moline plant in 2004.

As always, we welcome your feedback. You can send comments and story suggestions to kschmidt@lessitermedia.com. Until next time, thanks for joining us.

Post a comment

Report Abusive Comment