In today’s newscast, we discuss Deere’s suggestion that we’ve turned the corner on the current ag equipment downturn, artificial intelligence in ag, what the Tax Cuts and Jobs Act means for farm equipment dealers, Titan Machinery’s outlook for fiscal year 2018 and a drop in producer sentiment.

Leave a comment Get New Episodes Delivered to Your Inbox

On the Record is brought to you by AgDirect.

Built for agriculture and powered by Farm Credit, AgDirect serves the ag equipment financing needs of equipment dealers across most areas of the U.S. It’s among the fastest-growing equipment financing programs of its kind – offering equipment dealers and manufacturers a reliable, risk-free source of credit for equipment financing and leasing on ag equipment — including irrigation systems. Along with attractive rates, AgDirect’s financing terms are among the most flexible in the ag equipment business — matching the income stream of ag producers. Discover why more dealers and their customers are choosing AgDirect to finance, lease and refinance ag equipment by visiting AgDirect.com.

On the Record is now available as a podcast! I encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We're interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

You May Also Be Interested In...

What do you get when the son of the local New Holland dealer marries the daughter of the local Case IH dealer? While this sounds like the start to a bad joke, it’s actually the foundation of the Ellens Equipment ownership team, a couple who knows a thing or two about running a successful dealership and who treats the business like another one of their children (including knowing when it’s time to let them spread their wings).

I’m managing editor Kim Schmidt, welcome to On the Record! Here’s an update on what’s currently impacting the ag equipment industry.

An End to the Ag Equipment Slump?

When John Deere reported its latest quarterly earnings in November, the farm equipment manufacturer suggested the ag equipment industry is turning the corner out of the current downturn. The company is anticipating North American ag equipment sales to be up 5-10% in 2018.

While another bumper harvest is keeping crop prices — and farmer income — under pressure, Deere’s report, along with the latest flash report from the Assn. of Equipment Manufacturers suggests farmers are once again buying equipment.

It appears, replacement demand has returned says Tony Huegel, Deere’s director of investor relations. That said, Ann Duignan , an analyst with JP Morgan notes that high horsepower tractor demand is still 25% below “normal.”

But she also says, “Dealers are now in better shape, so they are more willing to take a trade. Lower structural costs are supporting incremental profits (despite the mix implications of a weak demand environment in the North American row-crop segment), though some of the savings are being offset by selective investments in areas such as R&D.”

Mig Dobre, analyst with RW Baird, says Deere’s growth forecast for North America, Europe and South America is supported by strong early order programs for seasonal product and a solid order book for large tractors. Deere’s small Ag & Turf product sector is expected to experience significant growth, benefitting from new product introductions, he says.

Dealers on the Move

This week’s dealer on the move is Agriterra. The AGCO dealer has acquired Dennils Agricenter, adding two stores in Vegreville and Dewberry, Alta. With this acquisition Agriterra has contiguous coverage from Edmonton to the Saskatchewan border.

Now here’s Jack Zemlicka with the latest from the Technology Corner.

The Reality of Artificial Intelligence in Ag

The term artificial intelligence, or AI, as it relates to agriculture, is often equated with other trending technologies like autonomous equipment and field sensors.

But AI-based equipment is distinct in that rather than being programed to perform a function, it’s being designed to interpret data pulled from the field, act on it and teach itself best practices in the process.

Ohio State ag engineering professor Scott Shearer envisions a future where less equipment ownership is necessary on the farmer’s end. That could come in the form of leasing equipment or contracting for the service of AI-enabled equipment.

Those changes could have a serious effect on how dealerships operate, but Shearer says the need for specialized service isn’t going anywhere — even if it changes shape.

“It’s going to be essential as AI makes supervised autonomous equipment possible to have service available 24/7. Farmers aren’t going to go for this thing if a tractor is down for 2 days because I can’t get someone to come out and service it. On the other hand, with smaller equipment you might be able to warehouse all the parts essentially in the bed of a pickup truck. So, that changes the dynamic a bit in terms of being able to service the needs of a larger fleet, numbers wise, of much smaller equipment.”

While it’s still going to take some time to separate the science from the fiction of AI-capable tools in ag, Shearer expects the industry will likely first see “supervised autonomy” with farmers watching over a handful of equipment in the field and monitoring performance.

Tax Reform to Mostly Benefit Dealers

The U.S. Senate passed the Tax Cuts and Jobs Act on Dec. 2, and there are a number of aspects of the bill that are good news for farm equipment dealers.

We spoke with Natalie Higgins, vice president of government relations for the Equipment Dealers Assn., and Rex Collins of HBK, EDA’s tax expert, to find out what sort of impact this tax reform would have on farm equipment dealers.

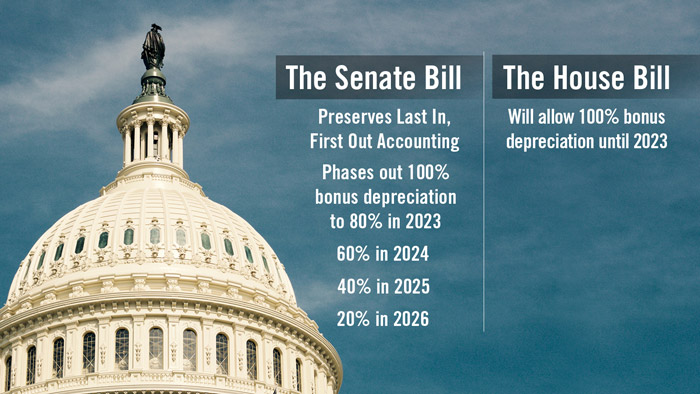

The Senate bill preserves Last In, First Out accounting, which is an issue EDA has lobbied for extensively, Higgins says. In addition, it phases out the 100% bonus depreciation to 80% in 2023, 60% in 2024, 40% in 2025 and 20% in 2026. The House version of the bill would allow 100% bonus depreciation until 2023.

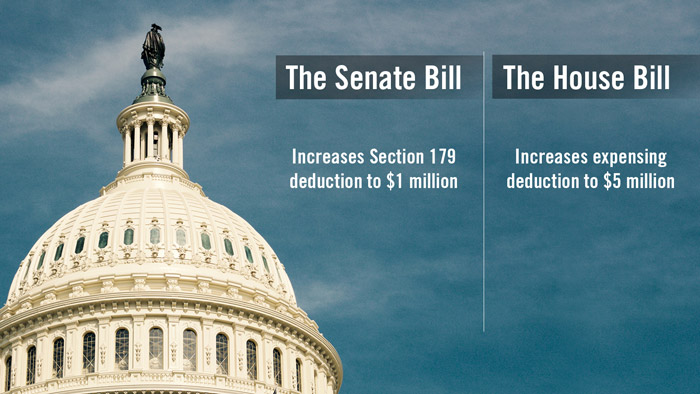

The Senate bill also increases the Section 179 deduction to $1 million, while the House version increases the expensing deduction to $5 million.

Collins says one of the biggest wins for dealers relates to deductibility of interest.

“We were able to get a carve out for dealers benefit, to the benefit of equipment dealers relative to deductibility of interest. Under both the House and the Senate proposal, interest deductibility is limited. Natalie was able to coordinate a call with us … and the House Ways and Means Committee where we were able to explain to the members of the committee that dealers floorplans … they are so dependent upon borrowing for their inventory that it would have very significant detrimental effect. We gave them some examples of what the impact would be on dealers that was above and beyond what we felt like was the intent of the proposed legislation was.Thankfully they agreed with us. So that probably is the biggest win for dealers that may not even be recognized as a win, if you will, because we jumped in front of it and handled it before it became a problem.”

The one area that may hurt some dealers is the elimination of Like Kind Exchange. As a result of the LKE limitations in both the Senate and House bills, farm equipment dealers and their customers will no longer be permitted to use LKE when purchasing replacement equipment. However with increased Section 179 and bonus depreciation levels, agricultural dealers and their customers will likely be able to mitigate some the impact of the tax on the gain.

Collins and Higgins say this could be particularly hurtful for dealers who carry large rental fleets.

Higgins says it is likely the final version of the bill will be sent to President Trump before Christmas. EDA and HBK will be hosting a webinar to go through the bill and its impact on dealers on Dec. 21.

Titan Machinery Ups FY2018 Outlook

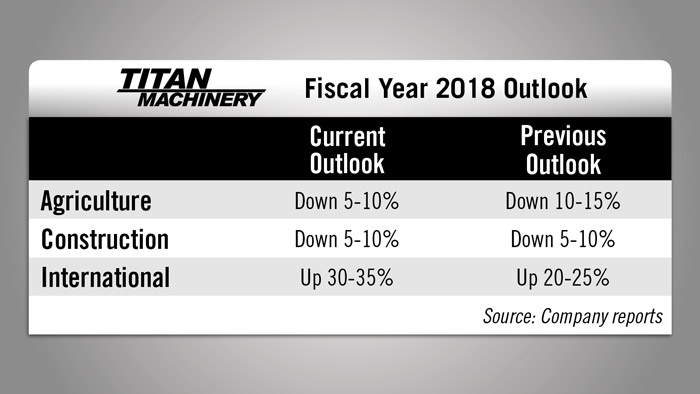

Citing “improved customer sentiment” in its agriculture segment and “continued growth” in its international markets, Titan Machinery raised its sales guidance for fiscal year 2018.

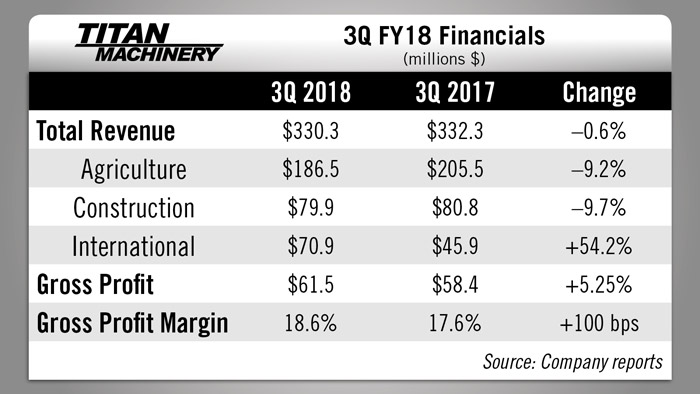

On Nov. 30, Titan, North America’s largest farm equipment dealer group, reported total equipment revenue for the quarter was up 1.8%. Much of the improvement was attributed to a 54% year-over-year increase in Titan’s international sales.

Overall, total revenue for the period was $330 million, down less than 1% vs. a year earlier. Agriculture revenues were down 9.2%, construction was down 9.7%. Gross profit increased 5.2% to $61.5 million and gross profit margin was up a full percentage point to 18.6%.

Titan’s ongoing effort to reduce used inventory continues to improve the company’s overall performance. It reduced its used inventory in the period by nearly $21 million and by $46 million, or 29%, year-to-date. The company increased its new equipment inventories by nearly $38 million based on growing customer confidence and improved fourth quarter demand.

In its outlook for the full year, Titan expects agriculture revenues to be down 5-10%. Its previous outlook called for a decline of 10-15%. It is forecasting international revenues to increase by 30-35% compared to its earlier projections of a 20-25% increase. The dealership group also expects 7.5-7.9% equipment margins vs. its previous outlook of 7-7.5%.

Producer Sentiment Drops Following Harvest

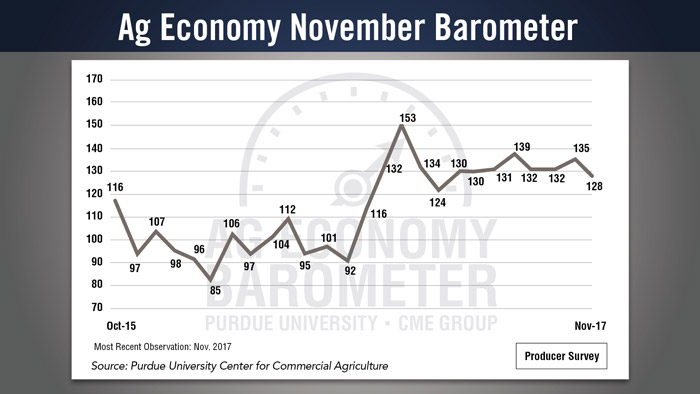

Purdue University’s Center for Commercial Agriculture released its latest Ag Economy Barometer report on Dec. 5. Agricultural producer sentiment turned lower in November, driven by a decline in optimism about future economic conditions in agriculture.

Although the decline in sentiment pushed the Ag Economy Barometer reading to its second-lowest level of 2017, sentiment remains much more positive than it was prior to the fall 2016 election.

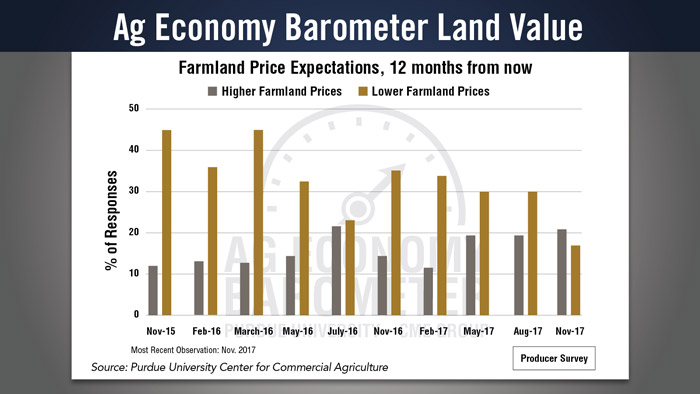

Producer expectations regarding farmland values appear to have strengthened somewhat as more producers expect farmland values to increase than decline in the next 12 months, the first time this has happened since data collection began in October 2015.

However, the biggest shift in producer expectations regarding farmland values seems to be a movement away from an expectation of weaker values to an expectation that values are likely to remain unchanged over the next year.

And now from the Implement & Tractor Archives…

Implement & Tractor Archives

One hundred years ago, the tractor was a very different piece of equipment, according to Debra Reid, curator for agriculture and environment at the Henry Ford Museum in Dearborn, Mich.

She says, “Before the one-man tractor, plowing required two men — one to drive the team and one to handle the plow. With the advent of large traction engines and multiple-bottom plows, an engineer often operated the steam engine while a man rode on the tractor to manage plow levers. Still another man walked along to knock weeds and roots off the plow bottom.”

But in 1903, two University of Wisconsin graduates in Charles City, Iowa — Charles Hart and Charles Parr — built 15 machines powered by the two-cylinder gasoline engine they had developed, according to the Smithsonian Institution. They called them “tractors,” a term with Latin roots that combined the ideas of “traction” and “power.”

The new tractors could be operated by one man, but they were 7-ton behemoths, so very few farmers took to the new machines.

As always, we welcome your feedback. You can send comments and story suggestions to kschmidt@lessitermedia.com. Until next time, thanks for joining us.

Post a comment

Report Abusive Comment