In today’s newscast, we share Carlo Tonutti’s story of losing control of his family’s company, Tonutii-Wolagri, and how after a 2.5 year struggle he’s regained ownership, how the Internet of Things fits in the ag landscape, New Holland’s new methane-powered concept tractor, and an upswing in equipment sales in Germany.

Leave a comment Get New Episodes Delivered to Your Inbox

On the Record is brought to you by AgDirect.

Built for agriculture and powered by Farm Credit, AgDirect serves the ag equipment financing needs of equipment dealers across most areas of the U.S. It’s among the fastest-growing equipment financing programs of its kind – offering equipment dealers and manufacturers a reliable, risk-free source of credit for equipment financing and leasing on ag equipment — including irrigation systems. Along with attractive rates, AgDirect’s financing terms are among the most flexible in the ag equipment business — matching the income stream of ag producers. Discover why more dealers and their customers are choosing AgDirect to finance, lease and refinance ag equipment by visiting AgDirect.com.

On the Record is now available as a podcast! I encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We're interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

You May Also Be Interested In...

What do you get when the son of the local New Holland dealer marries the daughter of the local Case IH dealer? While this sounds like the start to a bad joke, it’s actually the foundation of the Ellens Equipment ownership team, a couple who knows a thing or two about running a successful dealership and who treats the business like another one of their children (including knowing when it’s time to let them spread their wings).

FARM

MACHINERY

TICKER

AFN: $52.13 -4.87

…

AGCO: $73.37 +6.65

…

AJX: $0.52 +0.02

…

ALG: $101.12 +10.44

…

ARTW: $2.70 +0.55

…

BUI: $4.45 +0.00

…

CAT: $124.79 +7.02

…

CNHI: $11.98 +0.72

…

DE: $124.78 +8.45

…

KUBTY: $91.70 +3.12

…

LNN: $91.28 +6.72

…

RAVN: $30.85 +2.65

…

TWI: $10.49 +1.70

…

TRMB: $39.45 +0.54

…

VMI: $155.25 +10.05

…

CERV: $13.50 -0.10

…

RME: $10.76 -0.36

…

TITN: $13.04 +1.97

…

TSCO: $60.75 -0.19

...

Closing Stocks as of 9/21/17 (Compared to Close on 9/7/17)

I’m Managing Editor Kim Schmidt, welcome to On the Record. Here’s an update on what’s currently impacting the ag equipment industry.

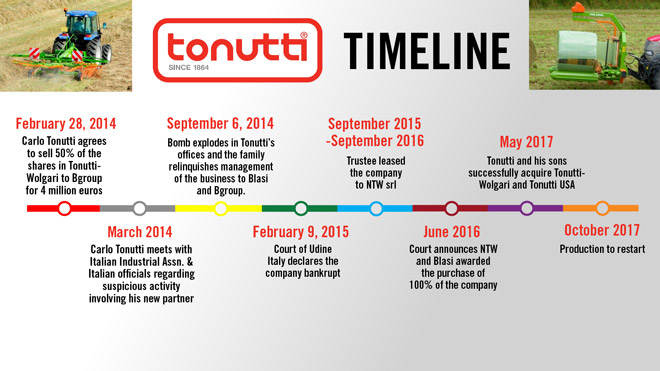

Tonutti-Wolagri Returns to Family Ownership

After 2 years of legal battles, Carlo Tonutti, the fourth generation of the Italian farm equipment manufacturer Tonutti, has regained possession of the company bearing his name. Tonutti-Wolagri, which was founded in 1864, has 3 manufacturing plants in Italy as well as operations in Russia and the U.S, with a Chinese operation in progress.

Last May, Tonutti won the court-appointed auction with two other suitors and managed to re-acquire Tonutti Wolagri and Tonutti USA, which had fallen into bankruptcy following a very unusual set of circumstances.

Tonutti shared what he calls a “nightmare” with Ag Equipment Intelligence in a series of correspondences last week, much of which reads like a movie script, complete with death threats, police surveillance, animal killings and an explosion at the company’s headquarters.

Tonutti notes the trouble for his firm began at the end of 2013, when the company needed to look outside for capital. He decided to merge with entrepreneur Luigi Blasi, then president of Bgroup. Bgroup was active in agricultural machinery and held the Bargam trademarks.

With an agreement signed on February 28, 2014, Carlo Tonutti agreed to sell 50% of the shares in Tonutti-Wolagri to Bgroup for 4 million euros, with the agreement to merge and strengthen the commercial network for greater effectiveness in product and product marketing policies.

Tonutti says that Bargram paid the first 1 million euro immediately, which the Tonutti family put into Tonutti-Wolagri Spa, but the 3 million balance was never received.

Within 2 weeks of his new partnership, Tonutti recalls he was brought to a meeting with the president of the Italian Industrial Assn. and informed about the infiltration of organized crime and the history of a firm buying the assets for virtually zero investment after having pushed out the owners.

Tonutti says he dismissed it as a “movie story” and admittedly did not pay much attention to the warnings of the officers. “But we immediately realized that the person was not who we thought and that his goals were not to develop the synergies of the two companies.” And after a couple of weeks, everything the officers explained to him also happened to him, he says.

After a bomb exploded in Tonutti’s offices on Sept. 6, 2014, the Tonutti family relinquished the management of the business, which was passed to Blasi and Bgroup. Then, on Feb. 9, 2015, Tonutti recalls, the bankruptcy of the company was declared by the Court of Udine Italy.

Tonutti recapped the events as follow. The trustee leased the company to NTW srl (who then had Bgroup as sole partner and Luigi Blasi as general manager) from September 2015 to September 2016.

In June 2016, the court announced that NTW and Blasi was awarded the purchase of 100% of the company. The failure to pay the amount of 2.4 million euros by Blasi at the due date caused the company to go to auction once again.

On May 20, 2017, Tonutti, along with his sons, Fulvio and Gianmaria, officially returned after 2.5 years of battles to acquire Tonutti Wolagri and Tonutti USA. The restart of production will begin next month, says Tonutti.

While “the events of the last couple of years had nothing to do with the work and will of a family dedicated to farm equipment since 1864,” Tonutti says he realizes it is essential to regain customer trust that has been heavily damaged.

Extended coverage of the Tonutti story can be found on Farm-Equipment.com.

Dealers on the Move

This week’s Dealers on the Move includes Koenig Equipment and KanEquip.

Koenig, an Ohio-based John Deere dealership, is acquiring the assets and operations of Smith Implements Inc. The addition of Smith locations in Bloomington, Franklin, Greenfield, Greensburg, Richmond and Rushville, Ind., brings Koenig’s total locations to 13 in southwestern Ohio and southeastern Indiana.

Up until recently, Koenig had been one of very few dealerships to operate both John Deere and Case IH dealerships. As we reported previously, Redline Equipment acquired Koenig’s 4 Case IH stores in Indiana in August.

On Sept. 19, New Holland and Case IH dealer KanEquip announced it was closing its Clay Center, Kan., store in October. The dealership will have 8 remaining stores.

Now here’s Jack Zemlicka with the latest from the Technology Corner.

Preparing for the IOT Evolution

One of the more buzzworthy terms in the consumer business world is Internet of Things, or IoT for short. While a bit ambiguous, the IoT trend is emerging in agriculture with companies moving conceptual designs into commercial development.

Wrapped around the goal of smarter farming, IoT’s application in agriculture is rooted in integration, simplicity and efficiency.

But how far along is agriculture in its adoption of IoT concepts and what does the future hold for development of these progressive platforms?

Talking recently with several precision manufacturers, there wasn’t a consensus on how to currently define IoT in agriculture. But companies had a clearer sense of the potential that packaging products and services can provide for both dealers and customers.

Fabio Isaia, CEO of Topcon, discussed the opportunity to transition into a more integrated delivery model for hardware and software, through brand consolidation rather than viewing them as independent precision pieces.

“We are rebuilding our software to be pieced as a vertical application of the platform and we’re going to sell them to subscriptions instead of license. So it’s a big transformation and this is what we believe is going to happen everywhere. We see the big manufacturers are trying to go that way, so the market eventually will go that way. I mean everything now is connected. We are all connected. We are now going to use these applications ourselves like normal consumer people and we believe that in the interim every agriculture market will follow as well. This is exactly what they’re doing now.”

Isaia added that one of the transitional challenges will be getting some dealers to change their mindset on how they sell and service precision platforms going forward, emphasizing that collaboration will be increasingly essential to adoption of IoT tools.

Is the Future Methane Powered?

During the Farm Progress Show last month, New Holland executives introduced their latest concept tractor — one powered by methane or compact natural gas.

During the introduction, New Holland Agriculture Brand President Carlo Lambro said the concept engine “delivers the same performance and has the same durability as its standard equivalent, but with much lower running costs. It combines alternative fuels and advanced agricultural technology to create a vital link that closes the loop in the Energy Independent Farm’s virtuous cycle by running on the energy produced fro the land and waste products.”

According to the company, the methane-powered tractor offers a cost savings up of up to 30%. In real field conditions, the methane powered concept tractor produces at least 10% lower CO2 emissions and reduces overall emissions by 80% compared to a standard diesel engine. Its environmental performance further improves when fuelled by biomethane produced from crop residues and waste from farm-grown energy crops, which results in a virtually zero CO2 emissions profile, according to New Holland.

The concept, however, is not intended to fit with every operation. Bret Lieberman, vice president of North America for New Holland, says municipalities that already run garbage trucks and other vehicles on CNG are likely customers as well farmers who already have a digester in their operation. He says there are customers in areas like Vermont who are ready today for methane power.

“So when you take a look at the market potential in North America, when you talk about digesters on the ag application, it’s probably about 400 digesters in the marketplace today. So a pretty small scope, but we know there are pockets in North America where there are customers today who would love to have this technology. We’ve already had dealers come to us and say, ‘I have customers today that would buy that technology for their farm.’ As we look at compressed natural gas, we know that the accessibility is, let's call it considerable. And when you get into more municipal applications where they might be running their garbage trucks on compressed natural gas and we sell a considerable amount of units into the municipal space, whether it’s for snow removal or for highway mowing. So the access to fuel in those marketplaces is certainly there and available today and we’ve got a product that can run and deliver the same level of performance as a diesel engine both on horsepower and on torque curves while running at a lower operating cost and also reducing emissions on methane compressed natural gas by about 10% when it comes to CO2 and total emissions by about 80%.”

We reached out to Brian Carpenter, general manager of Champlain Valley Equipment, a 5-store New Holland dealership in Vermont, to get a dealer’s perspective on the introduction. He’s excited about the new technology and says, “Vermont is at the forefront of renewable clean energy, and having a supplier providing our customer base with additional tools to reduce their footprint is progress that feels right. We are in an environment where our producers are under mandates to reduce emissions, runoff, smell, noise, etc.”

The company claims the tractor could be ready for production within 3 years.

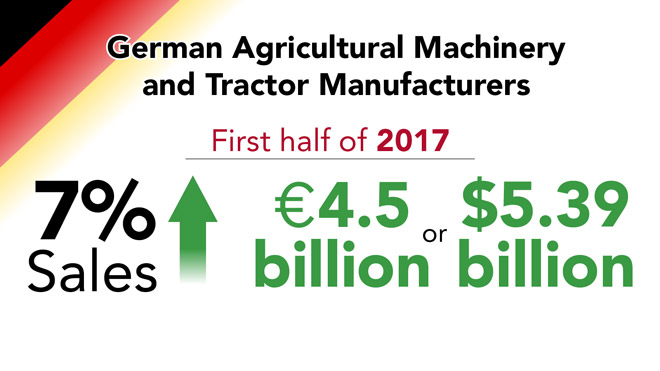

Germany Sees Upswing in Ag Machinery Sales

The ag equipment market in Europe is experiencing an economic comeback in numerous markets, according to VDMA managing director Dr. Bernd Scherer. He says double-digit growth rates in incoming orders, from Germany and abroad, are, “an important indicator of a sustainable upswing.”

In the first half of 2017, German agricultural machinery and tractor manufacturers saw a 7% increase in sales, to just over 4.5 billion euros or $5.39 billion.

The German association reports that overall, deliveries to German dealers and international distribution partners were noticeably higher than in the corresponding period last year.

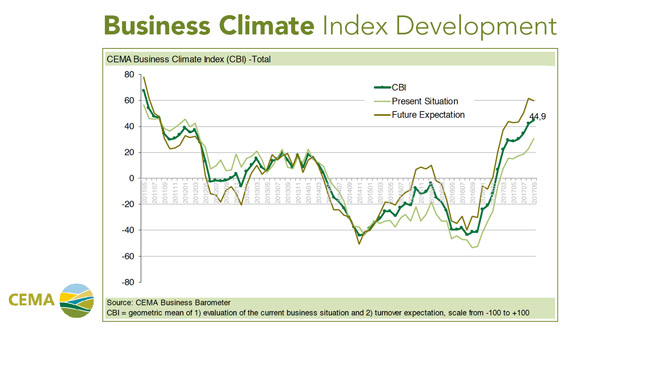

The CEMA business climate index, based on a monthly survey of executives in the European agricultural machinery industry, is currently at a peak level. In the view of just over 84% of the managers surveyed, the industry is clearly on a growth course.

This peak value of the index published by the European umbrella organization, CEMA, corresponds to that of the boom year 2012. “This is certainly not a flash in the pan, since the future forecast is just as positive as the assessment of current business,” said Scherer.

And now from the Implement & Tractor Archives…

Implement & Tractor Archives

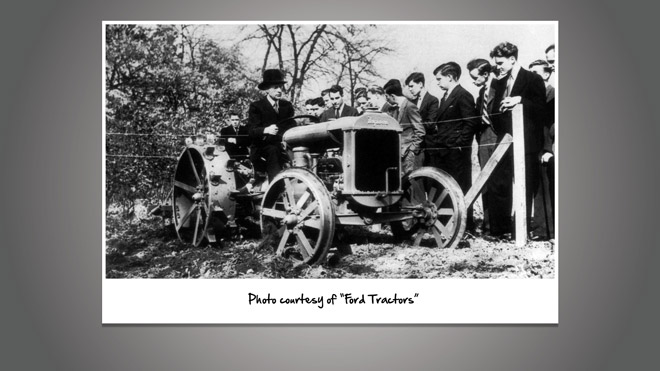

In 1938, Harry Ferguson demonstrated his Ferguson-Brown tractor, a joint-venture between Harry Ferguson and David Brown. It was the production version of Ferguson’s Black Tractor, which was the first to incorporate the hydraulic 3-point hitch and integrated implements. While the Ferguson-Brown was somewhat smaller than a Fordson and about twice as expensive, the performance was better enough to convince Henry Ford to build the 9N Ford Tractor featuring the Ferguson System.

As always we welcome your feedback. You can send comments and story suggestions to kschmidt@lessitermedia.com. Until next time, thanks for joining.

Post a comment

Report Abusive Comment